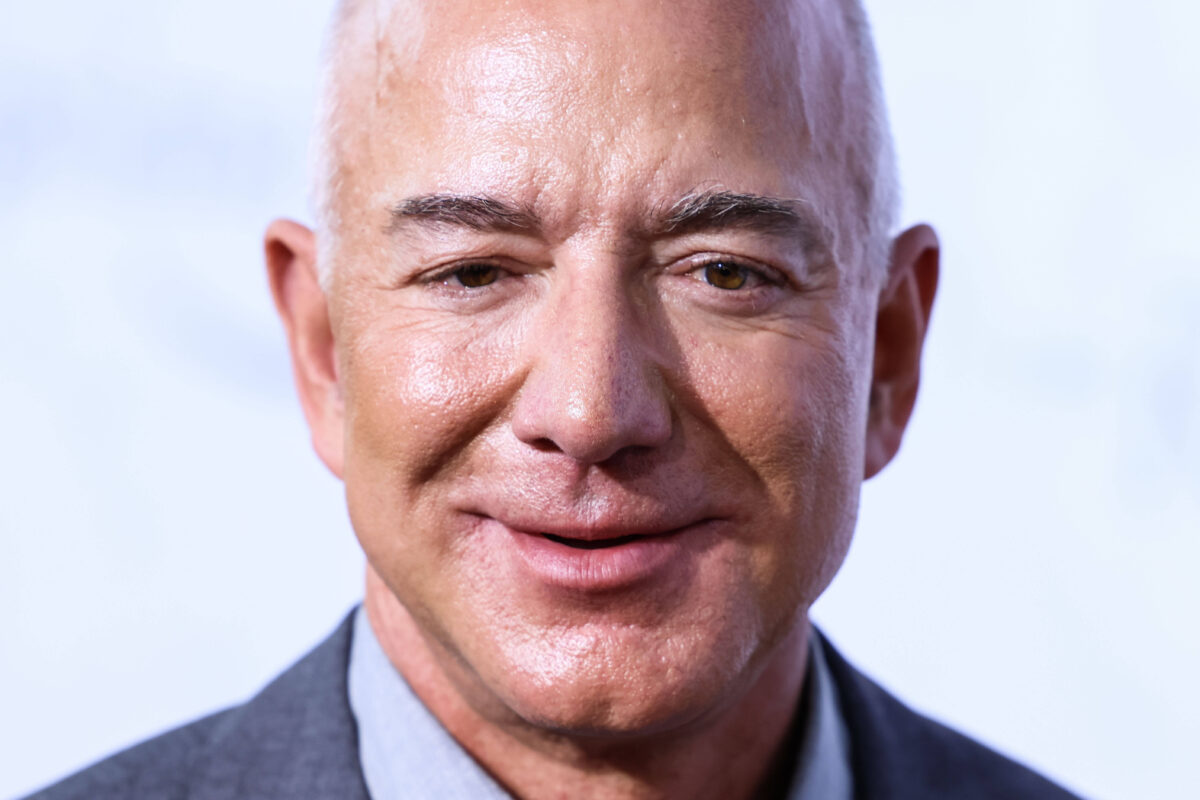

Amazon founder Jef Bezos has made a move that will see him save paying millions in taxes after selling a portion of his shares in the internet retailing giant.

In the past few months Bezos has relocated from Seattle in Washington to Miami in Florida. While neither state has state income taxes, the move does mean that Bezos won’t be subject to paying Washington’s 7% tax on capital gains in excess of $250,000 – which means he will save hundreds of millions of dollars.

Bezos has recently sold shares worth an eye-watering $4 billion, which means he will save himself $280 million thanks to relocating to Florida. Florida does not have state taxes on incomes or capital gains, although he will still have to pay federal taxes as a result of selling his shares.

The founder of Amazon has regularly sold off some of his shares in the company since 1998, but it is only in the past year that Washington has imposed the new capital gains tax levy.

Bezos announced his move to Florida back in November 2023. He founded Amazon in Seattle in the mid-90s, but at the time explained his decision to relocate to the state where he grew up in as to be closer to his elderly parents, who had also recently moved back to the area.

In addition, the operations of his space exploration company, Blue Origin, are increasingly moving to Cape Canaveral in Florida. Bezos has also said that he and his fiancé, Lauren Sanchez, love Miami.

Bezos is estimated to be worth about $194 billion, which makes him the third richest person in the world, behind Bernard Arnault, CEO of French luxury goods group LVMH, and Elon Musk, who owns X and Tesla, among others, although the share sale could change that.