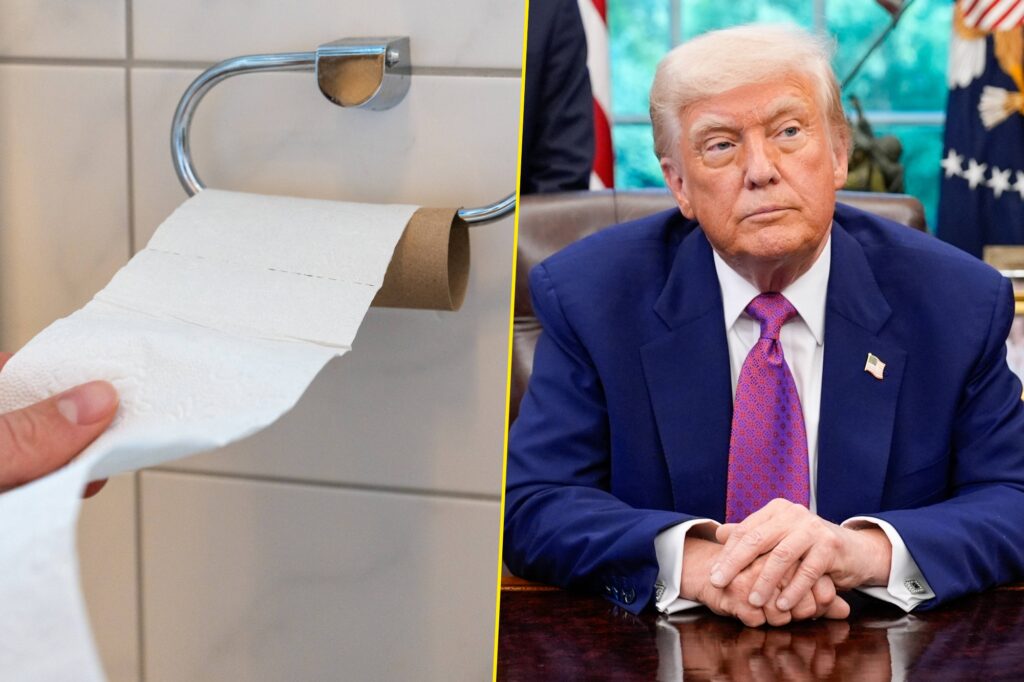

- Trump tariffs could lead to a US toilet paper shortage

- One of the biggest pulp importers has experienced disruption

- At the time of writing, levels seem okay

As the fallout from Trump tariffs continue to unfold, America could be poised for national toilet paper shortage.

The trade war initiated by President Donald Trump has caused chaos around many different sectors. Many different countries have been impacted too.

One area that is starting to feel the pinch is a global paper supplier that has experienced issues with shipments.

Read more: Trump threatens ‘country’ of Mattel with tariffs

One such company is Suzano SA, the leading exporter of paper pulp. This is something that’s integral in toilet paper production – but US levies are playing havoc with their shipments.

As reported on Bloomberg, this Brazilian company reported a 20% April decrease in exports headed for America. The company produces bleached hardwood pulp which is used to create many different types of toilet paper.

Read more: Trump consumes “insane amount of Candy” claims insider

That said, it isn’t time to panic just yet. While this news is no doubt disconcerting for any toilet fan, current toilet paper levels appear to still be okay across the country – for now at least.

“We’ve had to pass increased costs on to US buyers”

Speaking to Bloomberg, Suzano’s Chief Executive, João Alberto de Abreu, explained that Trump’s tariff war may mean higher toilet paper prices for American citizens.

“In response to the tariffs, we’ve had to pass increased costs on to US buyers,” explained Abreu.

Currently, Brazil is experiencing a 10% universal tariff on its exports. As trade barriers continue to unfurl, the company has hinted that supply chains could be impacted further, while prices could go higher.

Pandemic-inspired toilet paper panic buying

The news mirrors the kind of toilet paper panic buying that was experienced during the 2020 pandemic. Suzano was a major supplier of this product during that difficult period and it has warned that if tariff pressures continue, further pressure could be felt.

“Pulp isn’t just another commodity,” continued Abreu. “It’s at the heart of some of the most essential products we use every day.”

As for when these pressures could be felt, a predicted timeline suggests that Trump tariffs could lead to a halt in Chinese shipments by mid-May which would in turn impact levels on store shelves.

Of course, with news regarding these tariffs evolving daily, anything could change.